Jobs lost, trade in the red: will Europe’s auto future be made elsewhere?

When an industry is left to struggle under extreme strain, the social cost quickly shows. In 2024, suppliers reported more than 54,000 jobs to be cut, and already this year, another 22,000 job losses have been announced. This is not the result of a delayed shift to e-mobility but stems from a deeper competitiveness problem, with closures and bankruptcies now driving an increasing share of job losses. It affects all employees across the supply chain, from skilled plant workers to certified engineers, indicating that the feasibility of the transition is being tested more than ever.

On top of the strain facing workers, Europe’s position in global trade is under heavy threat. For the first time, the EU faces an automotive trade deficit in new mobility components – caused largely by a surge in battery imports from China, which have doubled in recent years.

The EU’s regulatory framework must evolve to ensure the automotive ecosystem can remain competitive in Europe. The sector is locked in a global race where competitors gain from subsidies and technology-neutral policies, while European companies are weighed down by rising costs, shrinking market share, and mounting job losses.

Urgent action is needed to relevel the playing field and address the industrial realities driving the sector into decline.

Archibald Poty, Trade & Market Affairs Manager

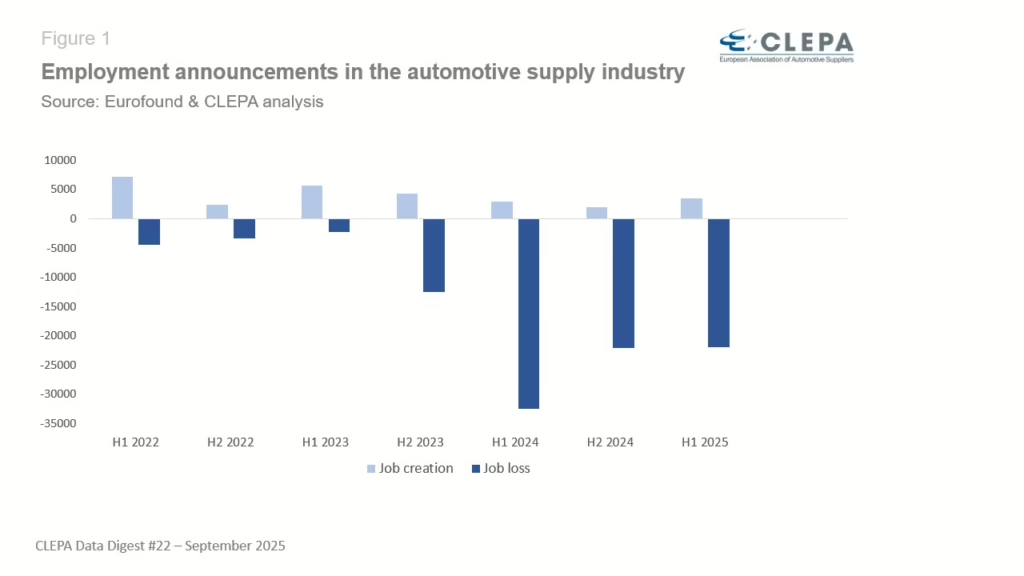

Employment downturn persists despite small hiring rebound

Job losses continue to affect the industry. In the first half of 2025, 22,000 job cuts were announced, down from a peak of 32,500 in the first half of 2024. Job creation shows only a modest recovery, with 3,500 new roles announced in early 2025 compared to 3,000 in the same period last year. The scale of hiring remains far too limited to offset the depth of losses, underlining an employment trend that continues to move in a negative direction.

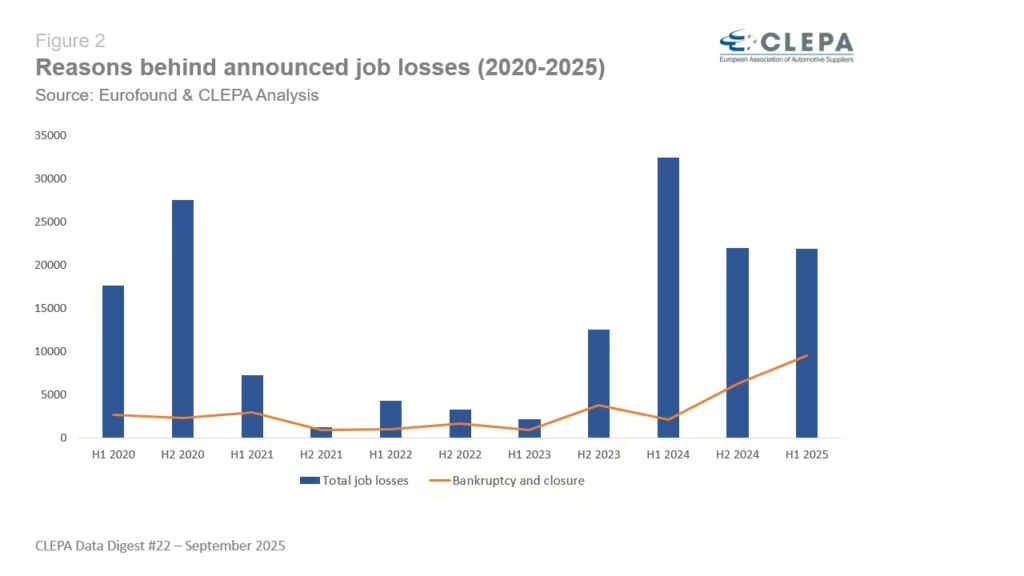

Closures and bankruptcies drive a growing share of job cuts

From 2020 to 2024 most job losses have been caused by internal restructuring, accounting for nearly two thirds of announced reductions. Closures and bankruptcies played a smaller role at 22%. This balance shifted in 2025. In the first half of the year, closures and bankruptcies reached 44%, representing nearly 10,000 announced job cuts. The rising share of closures and bankruptcies signals a deteriorating business climate and mounting structural pressures on suppliers.

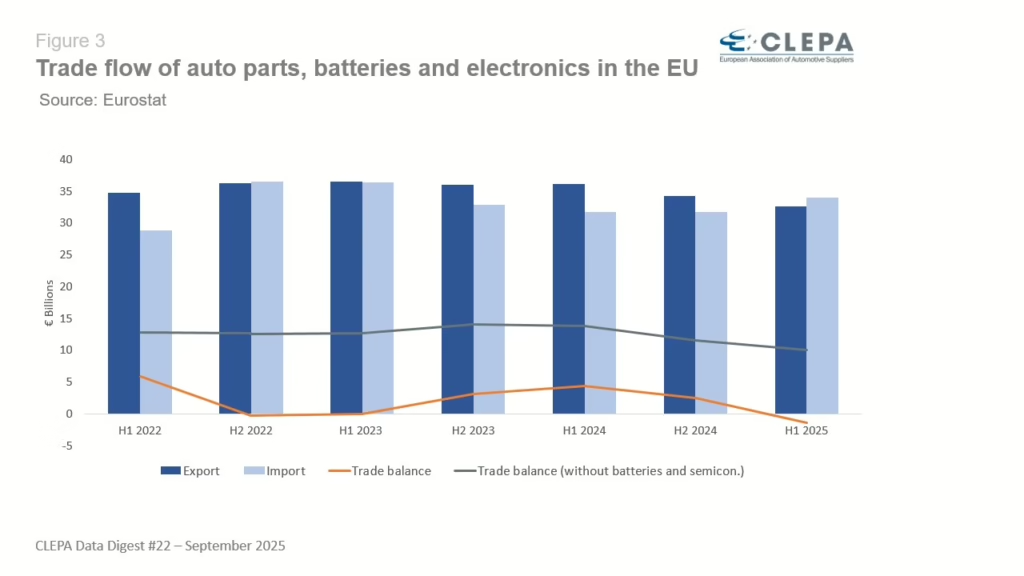

Trade balance turns negative as imports rise

While the EU was nearing a negative trade balance at the end of 2022, it has now clearly entered one. The global EU trade balance for auto parts, including batteries and electronics, fell into a deficit of €1.4 billion in the first half of 2025, after a surplus of 4.4 billion in the first half of 2024.

This shift can be explained by a range of factors. Exports of traditional automotive components declined by 10.5% compared to last year, while imports increased by 5.4%. At the same time, dependence on battery imports grew by 15% year on year.

Trade balance turns negative as imports rise (2)

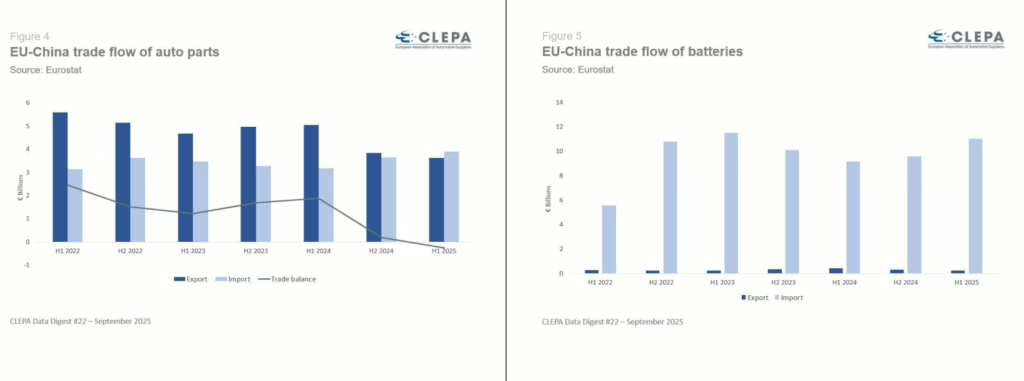

Moreover, trade with China is taking a different turn. While China once accounted for a large share of EU exports, the EU now faces a trade deficit of 265 million in automotive components with China, for the first time.

Battery trade is playing an increasingly large role: in the first half of 2025, EU battery imports hit €11 billion — double the €5.5 billion recorded in the same period of 2022.

Benjamin Krieger, Secretary General

Contact CLEPA Communications Team at communications@clepa.be