Factory closures overshadow EU’s mobility transition

The EU’s vision for a swift transformation will fail, unless policy makers change course. Automotive suppliers, as intermediaries between political ambition and market demand, are absorbing the shock waves of a sector in transition. Bankruptcies and site closures now account for half of the job losses, while investments continue to drop.

With 62% of companies grappling with overcapacity and unsustainable fixed costs, the next wave of job losses is imminent. Profitability is for the sixth consecutive year below viable levels for most suppliers, crippling their ability to reinvest and adapt. The most immediate casualty is future readiness: investment forecasts through 2030 have been slashed by over €22 billion, compared to last year, jeopardising Europe’s capacity to deliver on its digital and green ambitions.

Suppliers are bearing the full brunt of cost pressures, while demand remains stubbornly below what’s needed to produce new technologies competitively at scale, eroding the sector’s ability to maintain investment and putting critical capacities and know-how at risk.

The impact extends beyond factories. Livelihoods and regional stability are affected, as Europe’s green transformation could slip away. Without a significant overhaul of regulatory and policy frameworks, Europe stands to lose a crucial pillar of its manufacturing ecosystem—along with the innovation, jobs, and technological leadership it provides.

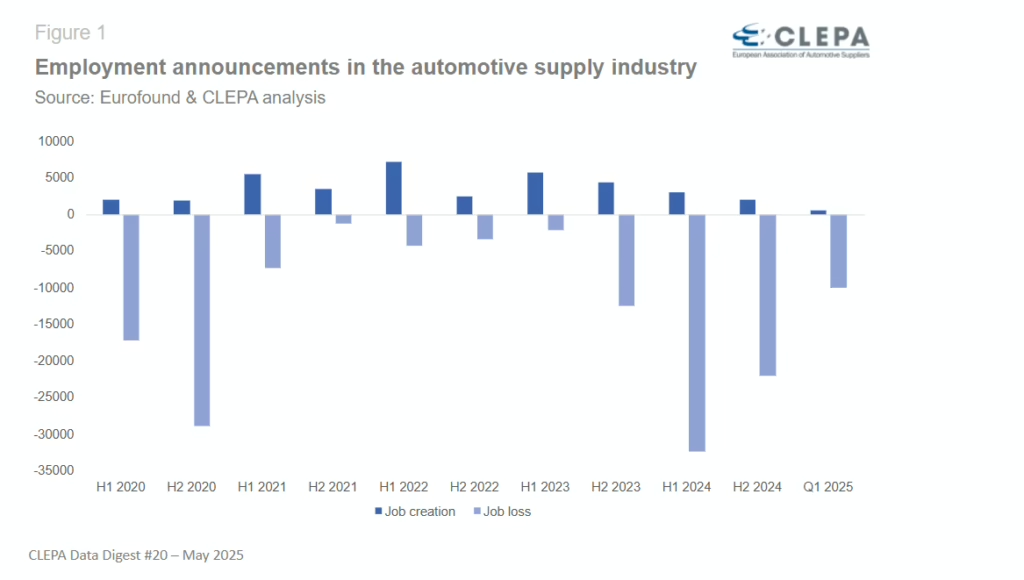

2025 starts with more job cuts, while EV job creation fails to materialise

After a difficult 2024, which saw nearly 55,000 job losses announced across the automotive supply industry, this year shows little sign of recovery. In the first three months of 2025, a further 10,000 job losses have already been announced,

proving that the ongoing wave is not over. The beginning of 2025 has done little to halt the hiring slowdown. Only 500 new jobs were announced, continuing a steady decline in job creation that has now lasted for five consecutive periods.

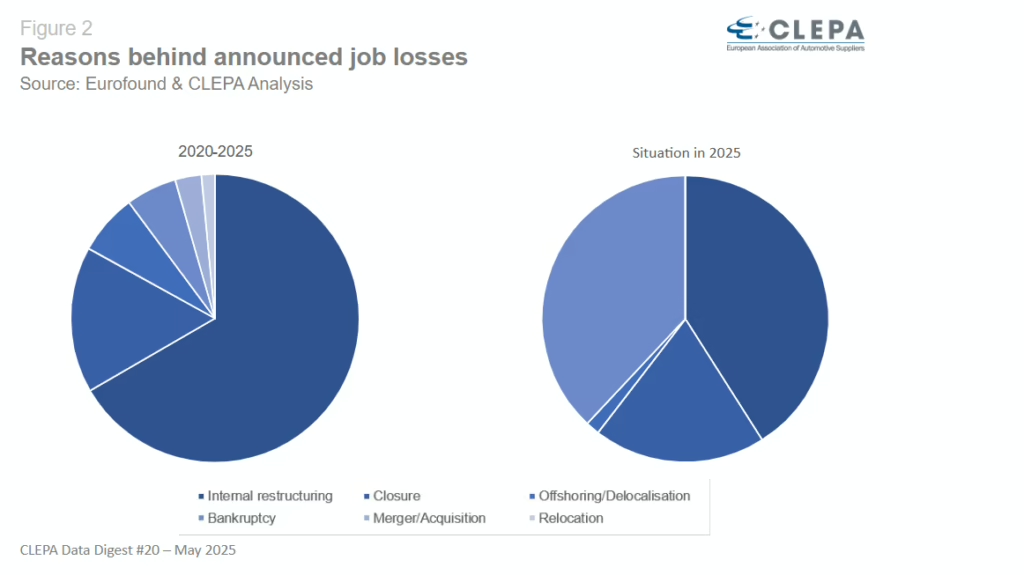

Closures and bankruptcies now drive majority of job losses

Since 2020, nearly two-thirds of announced job cuts in the automotive supply sector have been linked to internal restructuring, in efforts to reduce costs and address growing competitive pressures. Yet a growing proportion is due to more drastic events: 22.5% of job losses have resulted from company closures or bankruptcies, highlighting the toll of increasingly difficult regulatory and business environments in Europe.

This trend has intensified in early 2025, with 57% of reported job losses attributed to bankruptcies or site closures. At least eight factories or companies have shut down operations across Europe since January; the case of Northvolt standing out among them.

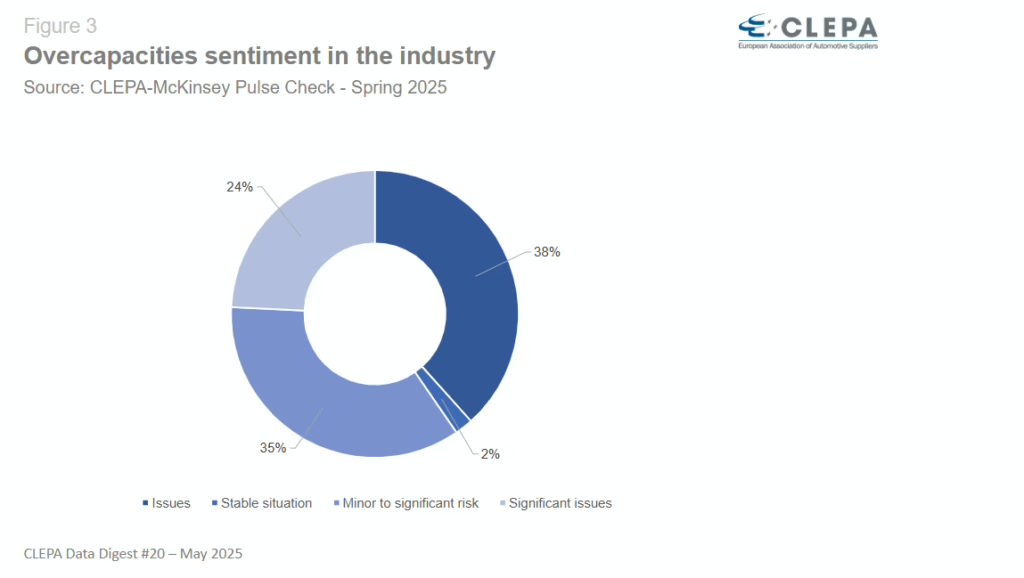

Overcapacities will lead to further job losses

The outlook for the automotive supply industry remains concerning, with 62% of respondents to the latest CLEPA-McKinsey Pulse Check reporting overcapacity and growing fixed costs – conditions that could lead to further downsizing and further job reduction in the near future. One in four companies cite insufficient fixed cost coverage in most of their production facilities at current demand levels. This points to continued pressure on margins and an increased risk of structural adjustment across the sector.

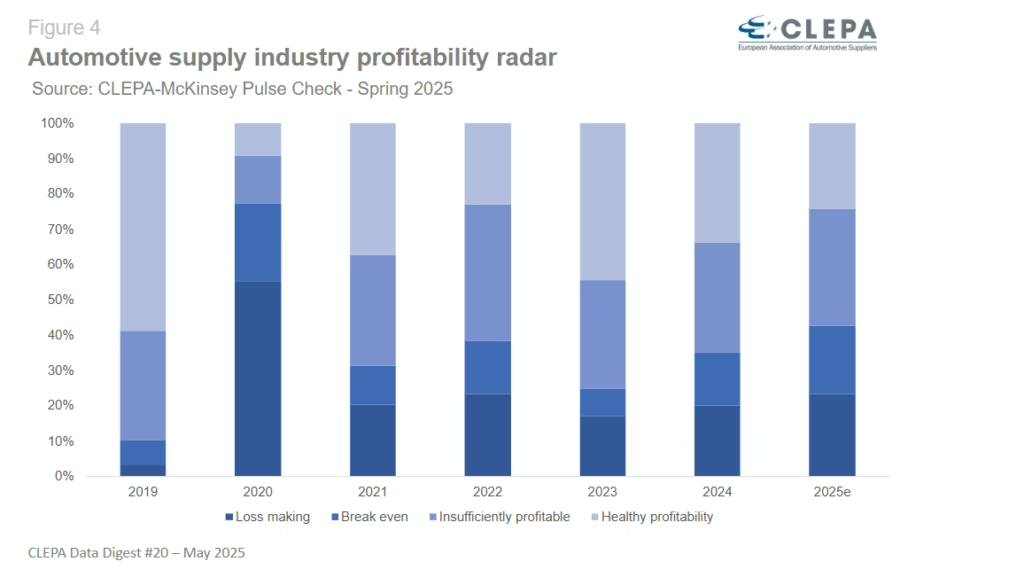

Lowest profit outlook since the pandemic

Profitability remains a major concern in 2025, with over 75% of automotive suppliers expecting profit margins below the critical 5% threshold considered as the minimum need to sustain long-term investments. Alarmingly, 42% anticipate operating with little to no margin at all, the highest number recorded since the pandemic shock in 2020. The outlook is shaped by a trio of mounting challenges: declining competitiveness, strained relationships with OEMs, and a slowdown in demand.

CAPEX forecasts cut by €22bn as investment outlook worsens

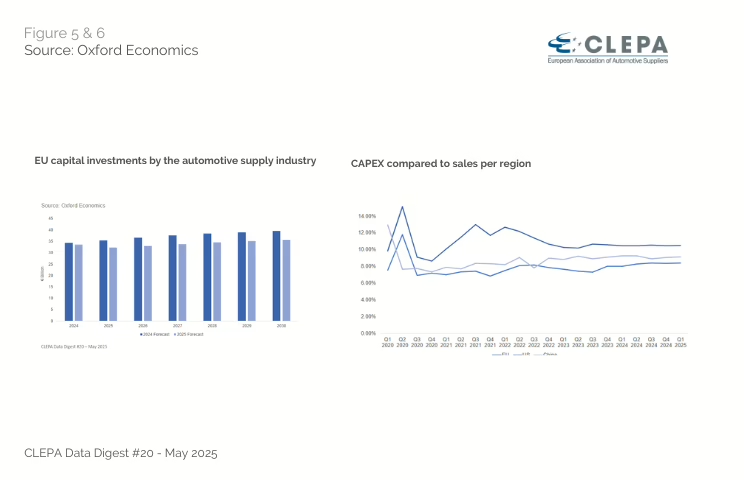

CAPEX (investments in building, machinery, R&D) forecasts for the 2025–2030 period have dropped by €22.3 billion since last year’s forecast, reflecting a significant deterioration in investment expectations. According to Oxford

Economics, annual investment is now expected to flatten at €35.6 billion by 2030, well below the €39.6 billion that was projected last year.

While Europe still leads compared to other regions in terms of CAPEX relative to sales, the trend is moving in the wrong direction. Since peaking at over 13% in 2021, the CAPEX-to-sales ratio has steadily declined and now stagnates at 10.4%. This slowdown comes as the scale and urgency of investment required to remain competitive in the green and digital transitions heighten. With margins under pressure, many suppliers simply lack the financial capacity to undertake the capital-intensive projects that transformation demands.

Benjamin Krieger, Secretary General

Contact CLEPA Communications Team at communications@clepa.be