Competitiveness gap: manufacturing in EU threatened by displacement

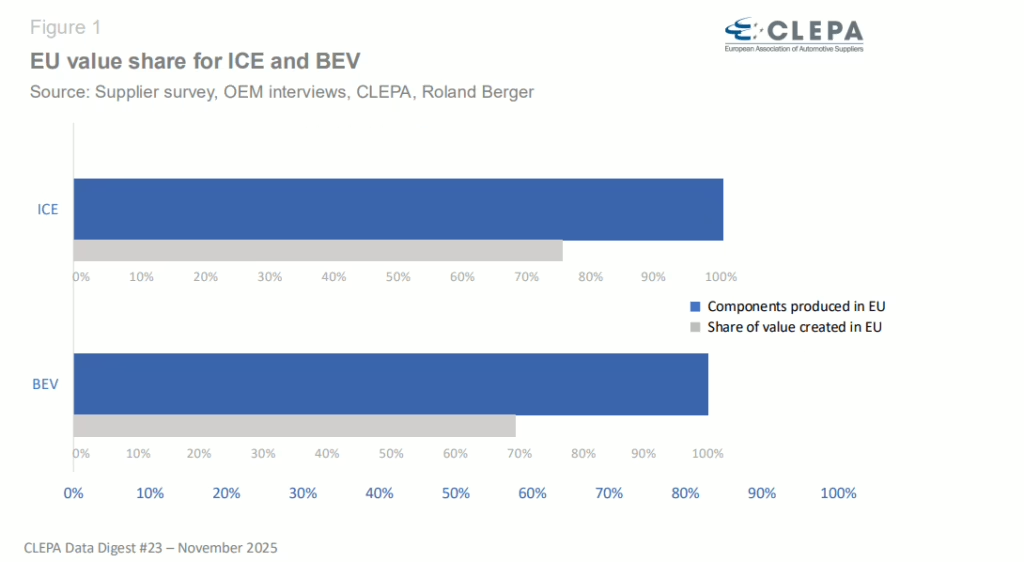

A strong and strategically backed automotive sector is essential for Europe to compete with other regions. With as much as 75% of vehicle component value produced within Europe, the continent’s automotive supply industry plays a vital role in driving economic growth and sustaining hundreds of thousands of jobs. Yet a study by Roland Berger on European value creation has raised serious concerns and the future of this vital industry is at risk.

The European Commission’s upcoming ‘Automotive Package’, expected on 10 December, is a pivotal moment to deliver decisive measures that strengthen supply chains and competitiveness. Without urgent EU action, the continent could lose its industrial backbone, jeopardising jobs and its leadership in clean mobility and innovation.

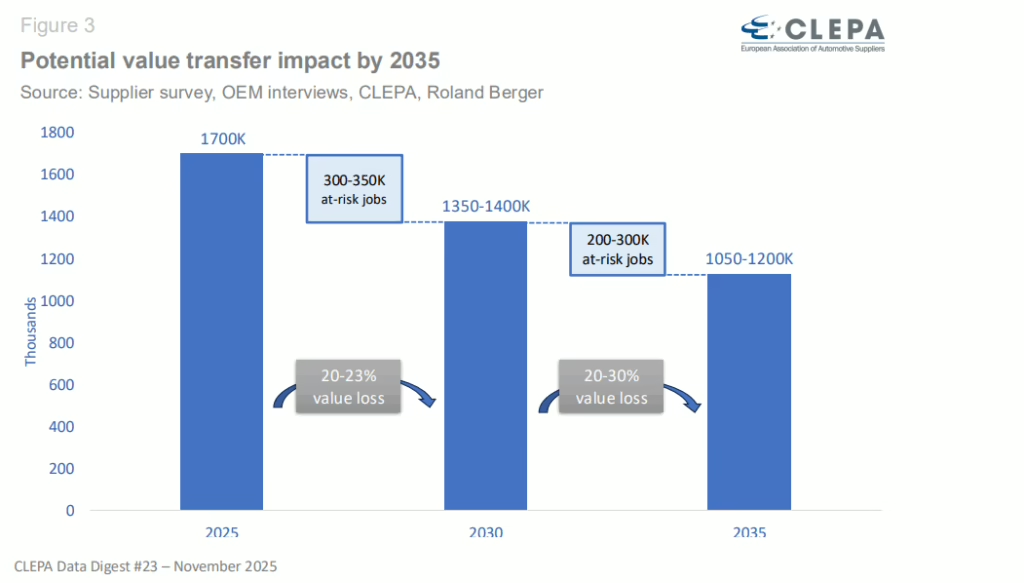

Europe currently faces up to a 35% cost disadvantage compared to other regions, driven by rising material, energy, and labour costs, along with stricter regulatory and carbon regimes. If left unaddressed, this could reduce value creation in car parts by 23% and put 350,000 jobs at risk by 2030.

Strategic political action is needed to reverse offshoring and protect manufacturing jobs. This includes technology-neutral CO₂ regulation that supports a range of low-emission solutions such as battery electric vehicles, hydrogen, and sustainable fuels. Local content requirements can help build regional ecosystems through targeted incentives, infrastructure development, and skilled workforce support.

Europe must act swiftly to safeguard its role as a competitive, self-sufficient automotive hub.

Benjamin Krieger, Secretary General

BEV/electronics supply chain dependencies push EU value share down

Most components for ICE vehicles assembled in Europe continue to be sourced locally. Around 85% of parts are produced within the EU, with 76% of their total value created inside the region. For BEVs, domestic sourcing remains comparable at 83%, but the share of value created in Europe is lower, averaging at 70% (not including batteries), as the wider value chain still relies on input from other regions.

Across component groups, EU value creation is highest for chassis, exterior and body, and interior systems. As production moves closer to the powertrain, the regional value share declines, falling to around 50% for electrical and electronic systems in both ICE and BEV vehicles.

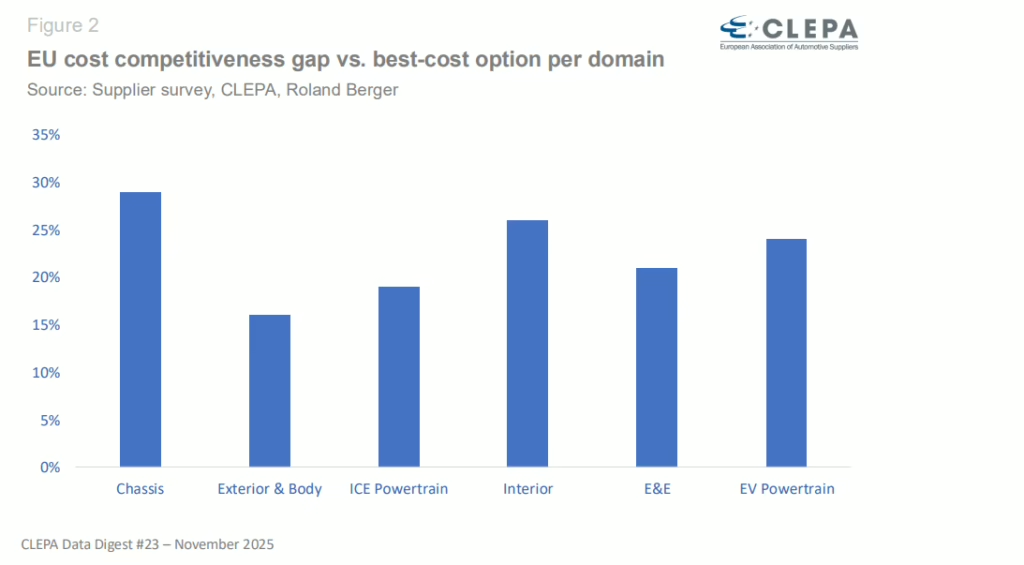

Europe faces a 15-35% cost disadvantage in key components

Europe’s cost competitiveness has continuously weakened across the automotive sector. Rising material, energy, and labour costs, combined with persistent inflation and burdensome regulations, have weighed heavily on productivity. Analysis across 36 automotive components groups shows a cost disadvantage of between 15-35% compared to best-cost regions in Asia and nearby production hubs. Moreover, Europe faces an uneven playing field, competing against regions where the entire supply chain benefits from substantial public subsidies, lower carbon costs, and less stringent environmental rules.

350,000 jobs at risk by 2030 amid mounting challenges

If current trends continue, European value creation in car parts could be reduced by up to 23% by 2030. This decline reflects both lower production volumes and reduced value per component as the powertrain mix shifts and value moves abroad. The impact on employment is significant: up to 350,000 jobs could be at risk by 2030.

For internal combustion and hybrid vehicles, loss of value is concentrated in electronics, interiors, and body systems, while for BEVs, the powertrain domain also emerges as a major source of risk.

Archibald Poty, Trade & Market Affairs Manager

Contact CLEPA Communications Team at communications@clepa.be