Structural pressures on Europe’s suppliers: policy delivery is key

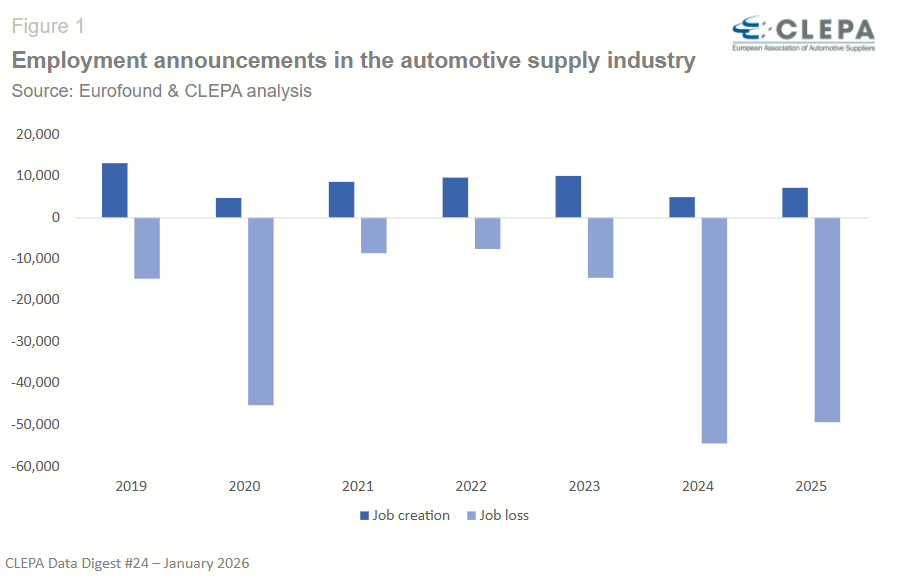

In 2024 and 2025 together, automotive suppliers have announced 104,000 job cuts – corresponding to around 142 jobs per day. The magnitude of these losses, over such a short period, exceeds even figures from the COVID pandemic and highlights the continued strain on suppliers as they deal with weak demand and cost pressures. Europe’s automotive supply industry faces a structural reset, and policy support has yet to meet the scale of this challenge.

The European Commission’s recent Automotive Package takes a first step in the right direction, including more flexible technology pathways and local content provisions. But further development is needed to create real flexibility and strengthen competitiveness and European production, without adding complexity and costs. The EU must lower energy prices and ease administrative burdens, while targeted measures are also needed to preserve critical production capacities in the region.

The upcoming Industrial Accelerator Act and its local content requirements could be pivotal, but unless they are designed to reinforce, not complicate, Europe risks slow growth and increased industrial erosion.

Benjamin Krieger, Secretary General

Job losses have surpassed 100,000 in only two years, dramatically outpacing the rate of new job creation

In 2025, the European automotive supply industry announced 50,000 job losses. Added to the 54,000 already recorded in 2024, this brings the total job cuts over the past two years to 104,000.

Only 7,000 new positions were announced in 2025, clearly showing that the current job creation has fallen dramatically short of compensating for the workforce reductions announced.

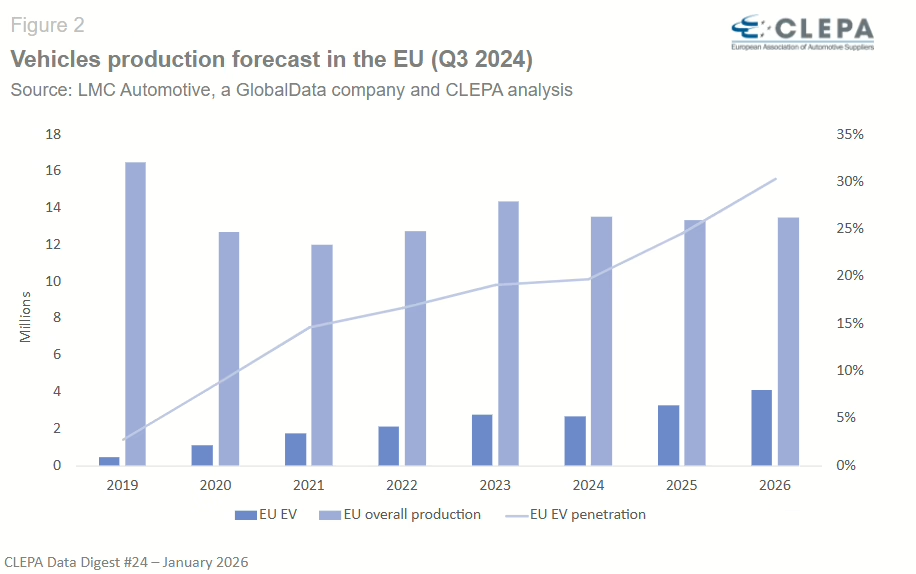

Despite growth in EV manufacturing, total vehicle output is still held back by persistent structural decline

According to GlobalData (LMCA)’s November 2025 forecast, EU electric vehicle (EV) production rose by 23% year on year between 2024 and 2025, reflecting a strong industrial commitment to electrification and sustained efforts by suppliers to scale up electric powertrain capacity. By the end of 2025, one in four vehicles produced in Europe is expected to be a plug-in hybrid (PHEV) or a battery-electric vehicle (BEV).

Despite this progress, EV output remains well below earlier expectations: the EU produced 3.3 million EVs in 2025, compared with the 4.8 million projected in 2023.

Moreover, total EU vehicle output in 2025 is projected to be around 20% below 2019 levels – equivalent to a shortfall of approximately 3.1 million units – pointing to a persistent structural gap in production. Overall output is expected to remain broadly flat from 2026 onwards, raising the risk that the industry locks in a permanently lower level of production.

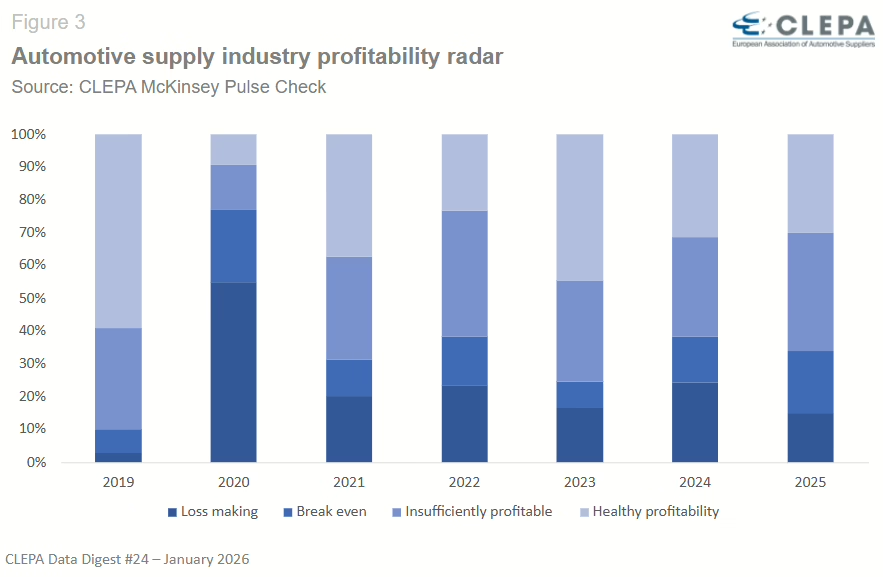

Profitability pressures persist, with healthy margins showing no real signs of improvement

The latest CLEPA/McKinsey Pulse Check survey (autumn 2025) indicates a modest improvement in financial outcomes compared to 2024: the share of suppliers reporting losses or break-even results declined from 38% to 34%. Unfortunately, this marginal shift does not signal a broad recovery, and the underlying financial pressures remain significant.

Supplier profitability has been steadily declining over the past three years. In 2025, only around one third of automotive suppliers expected to achieve EBIT (Earnings Before Interest and Taxes) margins above 5% – which is considered necessary to sustain long-term investment, innovation, and industrial transformation. This trend underscores the growing structural fragility across the European automotive supply base.

Contact CLEPA Communications Team at communications@clepa.be