Industry under pressure: Europe’s shrinking global role

While other regions race ahead, Europe’s industrial capability is at a crossroads. This Data Digest lays out the facts driving the growing urgency for Europe and its automotive supply industry. What are the key pain points that the EU must address to restore its global industrial competitiveness?

High energy prices:

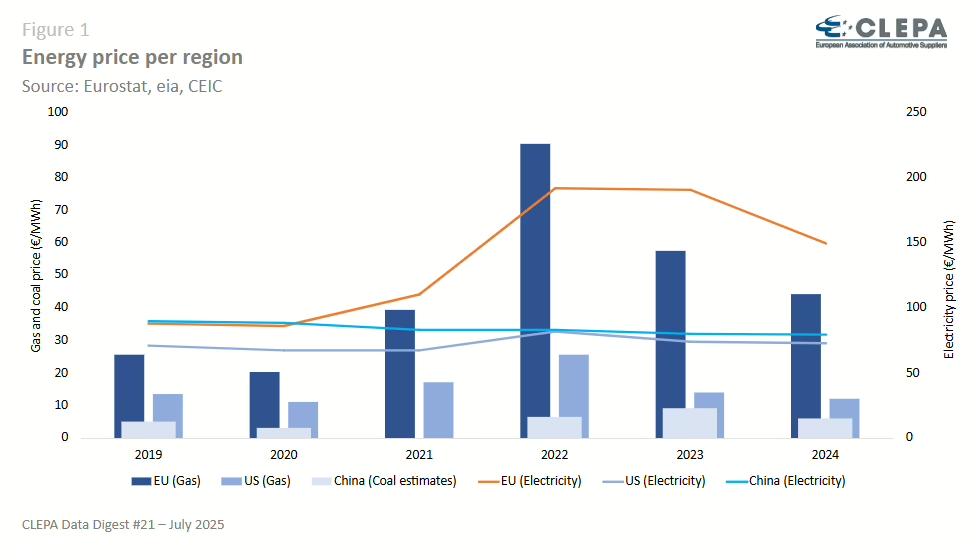

Though lower than during the 2022 peak, energy costs remain stubbornly high. Industrial electricity prices in the EU are twice as expensive as in the US and nearly 90% higher than in China. Natural gas, critical to automotive manufacturing, shows an even wider gap. This persistent cost disadvantage is squeezing Europe’s energy-intensive sectors.

Bold action to bring industrial energy prices in line with global competitors, and reducing the costs of doing business overall, is no longer optional – it’s a matter of survival.

Rigid regulation:

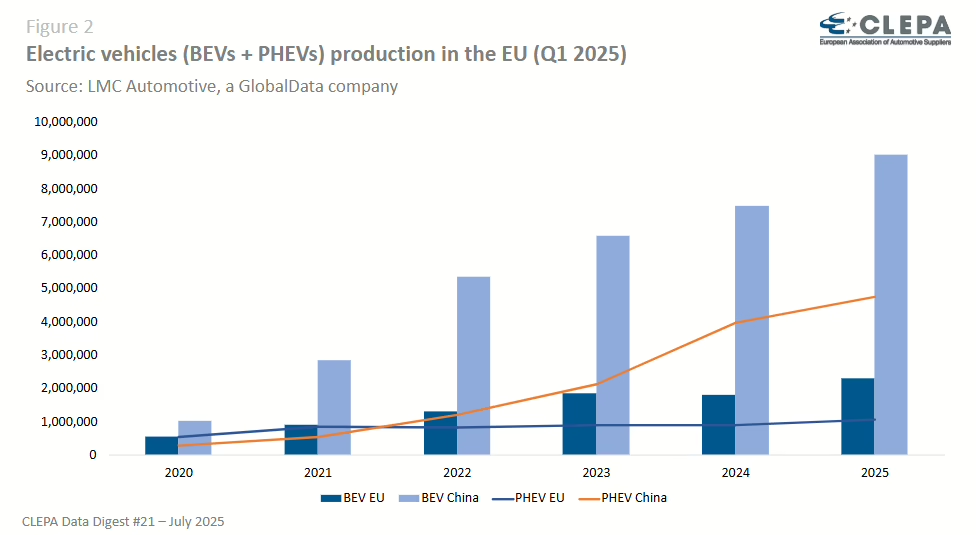

Strict policies are restricting the sector’s ability to adapt in a fast-evolving global market. While China supports both battery electric and plug-in hybrid vehicles (PHEVs), enabling broader market adoption and engineering innovation, Europe has largely sidelined PHEVs and other technology options in its regulatory framework. This narrow focus is drastically limiting consumer choice and slowing industrial momentum. Between 2020 and 2025, China’s EV production surged by over 12.5 million units—more than five times the output of the EU.

Technology openness is the key to a successful decarbonisation in the EU. The upcoming review of the CO₂ standards presents a crucial opportunity for a realistic assessment, backed by concrete plans to ensure feasibility. Similarly, adopting a technology-neutral approach to greening transport, including corporate fleets, will provide the flexibility needed to accelerate market uptake.

Declining investment:

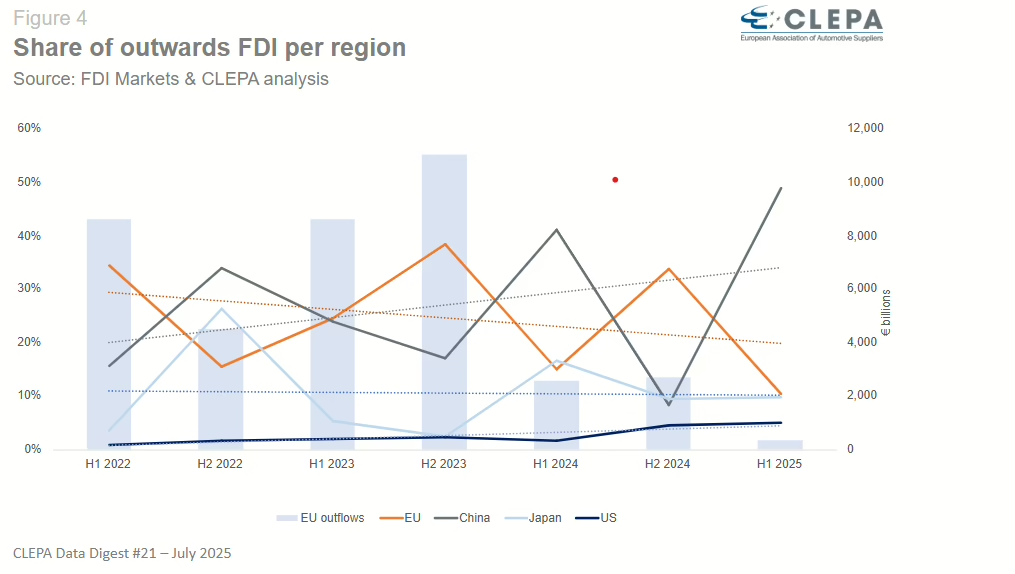

Closely tied to these regulatory and energy challenges, Europe is losing its appeal as an investment destination. Non-EU capital is flowing elsewhere, and European firms are retreating from global markets. The EU’s share of global foreign direct investment outflows has dropped – from 34% in early 2022 to just 10% in 2025 – while China’s has surged to nearly 50%.

To attract greater investment and provide certainty, EU policies must define clear, technology-neutral sustainability criteria that incentivise both foreign and domestic investors and strengthen Europe’s supply chains.

This is not just an industrial story – it’s a social one. As factories slow or shutter, entire communities risk losing stable jobs, skilled work, and economic purpose. Europe’s hard-won industrial fabric is fraying. Without urgent action to derisk investment, and unleash industrial innovation, the price won’t just be economic – it will be paid in livelihoods, fractured cohesion, and weakened long-term resilience.

Archibald Poty, Trade & Market Affairs Manager

High energy costs undermine Europe’s industrial edge

Despite retreating from their 2022 peak, energy prices in Europe remain well above pre-COVID levels and significantly higher than in competing regions. Industrial electricity prices in Europe are still twice as high as in the US and 90% more expensive than in China, continuing to erode the competitiveness of European manufacturers – particularly in energy-intensive sectors like automotive and industrial machinery.

The gap is even more pronounced for natural gas: in 2025, industrial gas prices in the US are less than a quarter of the prices in the EU. Although China relies more heavily on coal than gas, its overall energy costs remain markedly lower, reinforcing the cost advantage enjoyed by non-EU producers.

China pulls ahead in EV race, driven by a surge in PHEVs

Between 2020 and 2025, China’s EV market grew by over 12.5 million units – more than five times the expansion seen in the EU. Starting from similar production levels in 2020 (around 1.2 million units), the two regions have since taken sharply diverging paths.

China’s rapid growth has been powered by both battery electric vehicles (BEVs) and a surge in plug-in hybrid electric vehicles (PHEVs), which have become a cornerstone of its New Energy Vehicle strategy. By 2030, PHEVs are expected to account for roughly one-third of China’s EV output.

In contrast, Europe has taken a more targeted approach to BEVs, with PHEVs projected to represent just 10% of EV production by 2030 – highlighting a narrower approach to electrification.

China gains ground as EU loses investment momentum

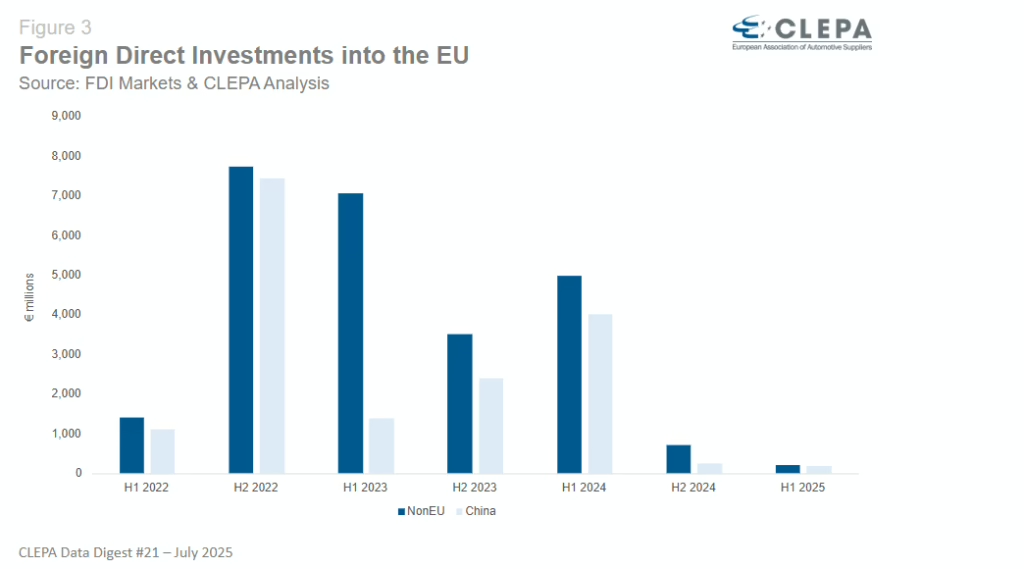

Foreign direct investment (FDI) into the EU from non-EU countries has collapsed since its peak in 2022, plunging from over €7.7 billion to just €218 million in the first half of 2025. This dramatic drop signals rising investor caution, driven by persistent uncertainty over Europe’s economic trajectory, regulatory environment, and industrial policy direction.

China has remained the most active non-EU investor, contributing nearly €194 million in 2025 – a figure that highlights, rather than offsets, the broader collapse in FDI. In recent years, China has consistently dominated non-EU inflows.

Europe’s share of global investment continues to erode

European companies are pulling back from global markets. In the automotive supply industry, EU foreign direct investment (FDI) outflows dropped sharply – from €11 billion in 2023 to just €341 million in 2025, the lowest level in three reporting periods. As a result, the EU’s share of global FDI outflows has plunged from 34% in early 2022 to just 10% by mid-2025.

China has rapidly filled the gap, overtaking the EU as the world’s leading automotive investor. Between 2022 and 2025, China’s share of global FDI outflows nearly tripled – from 16% to 49% – as Chinese firms expanded their international footprint and solidified their role in global supply chains.

Benjamin Krieger, Secretary General

Contact CLEPA Communications Team at communications@clepa.be